Written by Miguel Palacios

Deducting State and Local Taxes (SALT) from one’s federal tax bill was a godsend for those who live in big, liberal cities with exorbitant tax rates. President Trump, however, capped those deductions as part of the Tax Cuts and Jobs Act of 2017. This SALT cap has prevented the super-rich from not paying any federal taxes at all. It also means that residents in places like LA and NYC are taking notice of the high taxes their city and state charge, because they can no longer fully deduct them from their federal tax return.

Obviously the federal government should not be paying everyone’s state and local tax bills in the form of a deduction. But Democrats rely on this to be able to charge high taxes, to fund social programs and other costly liberal priorities, without too much push back from the population. If these democrats with deep pockets are so enthusiastic about social programs, however, they must accept that these programs are funded by taxes collected from tax-paying individuals and that the federal government can not foot the bill.

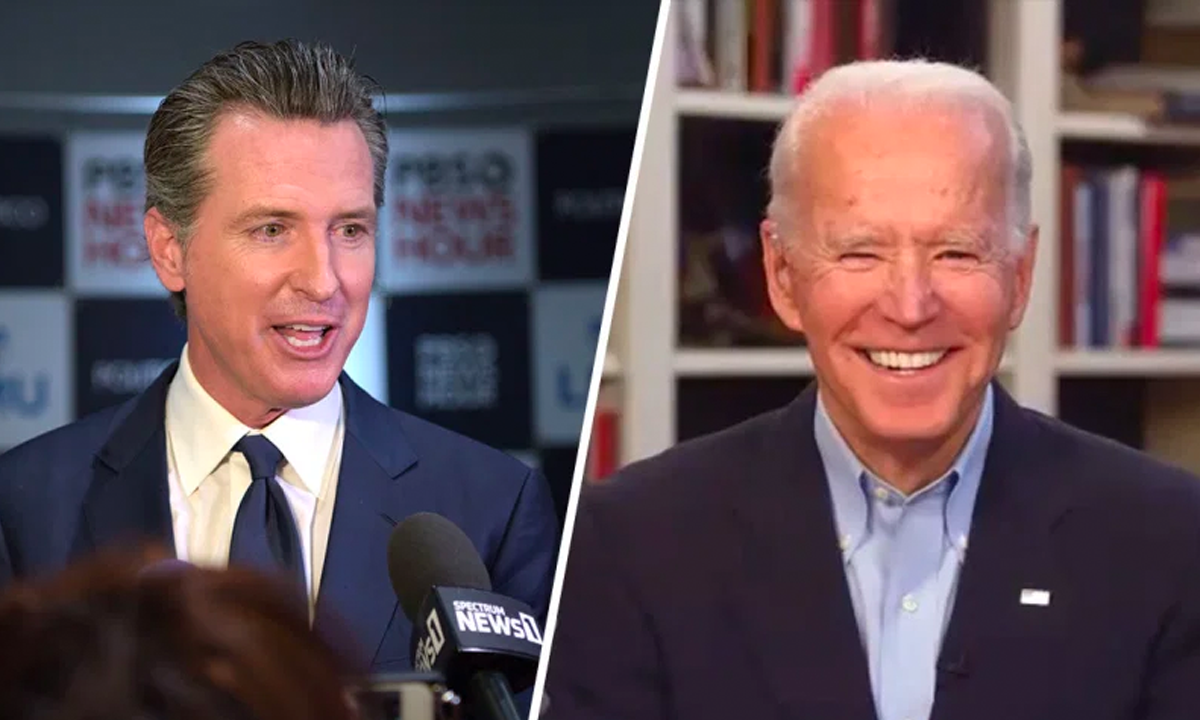

Now that Trump is gone, Governor Newsom along with five other Democratic state governors have joined together to ask President Biden to remove the $10k deduction limit on SALT payments; so that the federal government can foot the enormous tax bills for residents of their respective states. Those states include New York, New Jersey, Connecticut, Oregon and Hawaii. Paired with California, those governors claimed that “Like so many of President Trump’s efforts, capping SALT deductions was based on politics, not logic or good government. This assault disproportionately targeted Democratic-run states, increasing taxes on hardworking families.”

The truth is that the vast majority of tax-payers, including those in the states making this claim, don’t pay even close to the $10k limit for SALT payments and have been benefitting from the standardized deduction, which is often more than what the majority actually pay. Plainly, this means that the cap on SALT deductions has not disproportionately affected or targeted the hardworking families as these democrat governors claim. The issue here is the ridiculous tax rates in Democrat-run states, not the fact that the federal government is no longer footing the bill. The simple solution would be to cut unnecessary expenditures and reduce taxes, but Democrats leaders are not willing to put the financial wellbeing of their citizens over their costly agenda.

A 2020 analysis from the Brookings Institution found that 57% of the savings generated by repealing the cap would go to the top 1% of earners nationwide.

Photo via NBC Bay Area