Written by Nicholas Vetrisek

“The Congressional Budget Office has been embarrassed repeatedly by making projections based on the assumption that tax rates and tax revenues move in the same direction.” Thomas Sowell wrote this years ago in relation to the Congressional Budget Office, but it can be applied just as easily to California.

Assessment roll values are at an all-time high and have been increasing every year. A few examples of this are Sacramento County up 6.53% to $179 billion and Alameda County revenues increasing 7.13% to $321 billion. As a result of this, last year’s roll value increase alone resulted in an additional $75 billion in revenue. Despite this massive increase, however, far-left Democrats in government want to repeal the only thing stopping properties from being taxed as high as everything else: Prop 13.

California has the highest corporate tax, the highest gas tax, and the highest sales tax in the entire country. Yet, somehow, the state is so starved financially that it needs to remove protections for the only reasonable tax rate left. This is clearly designed to give more money to unions for their ever-increasing benefits and pensions in exchange for Democratic loyalty. The homeowning public be damned.

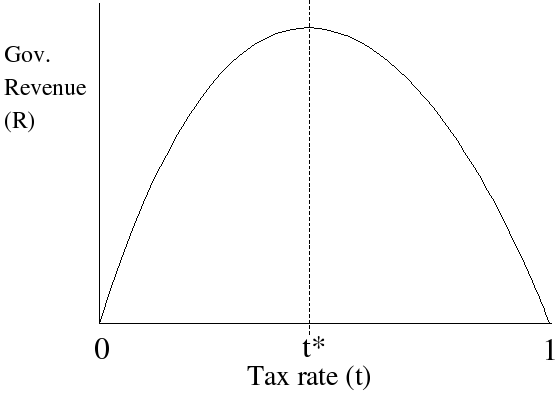

Aside from the obvious immorality of stealing from homeowners in order to give free stuff to supporters, there’s also no indication it would raise revenues anyway. Going back to the quote in the beginning, tax rate increases don’t correlate with revenue increases. In fact, they often go the opposite way.

One of the most important ideas in economics is the Laffer Curve; the idea that there is an ideal sweet spot for tax rates that allows for high enough revenues without forcing taxpayers to look for loopholes or to leave altogether. It’s not a very complicated idea and it is in fact so simple that it was originally written impromptu on a napkin.

Unfortunately, leftists politicians—with their Ivy League degrees and decades of government experience—are unable to understand such a concept. California is reaching peak revenues for property taxes because the rate has been capped for decades. Other taxes are not working because they are the highest in the country and as a consequence, countless people are leaving California.

This is simply another example of California Democrats making it harder for average people to live in the state. It may seem like this would be just another tax increase in a long line of them, but this could be the last straw for the middle and upper-class holdovers across the state.

Prop 13 has protected them for over 40 years and if it gets removed, it’s open season. If that happens, there will only be one more question worth asking: when did you decide to leave?