Guest Commentary by El Cajon City Councilman Steve Goble

So the majority of SANDAG’s board is backpedaling on the Road Usage Charge (aka Vehicle Miles Traveled or “VMT” tax), asking staff to look for replacement sources. How much money are we talking about? In the 2021 Regional Plan, VMT tax revenue is projected to total $24.4 Billion, or 9% of total Year of Expenditure (“YOE” or growth adjusted) revenue by 2050. That’s a lot of revenue to make up.

What likely infuriated their constituents most was the majority’s direction to charge the VMT tax on top of, not instead of, existing gas taxes, and even ADDING an assumption the federal gas tax would increase ANOTHER 39 cents from 2026-2048.

Here are other fees and taxes which didn’t make the news headlines BUT ARE STILL IN THE PLAN UP FOR A VOTE this Friday, December 10, 2021 (in $ Billions YOE):

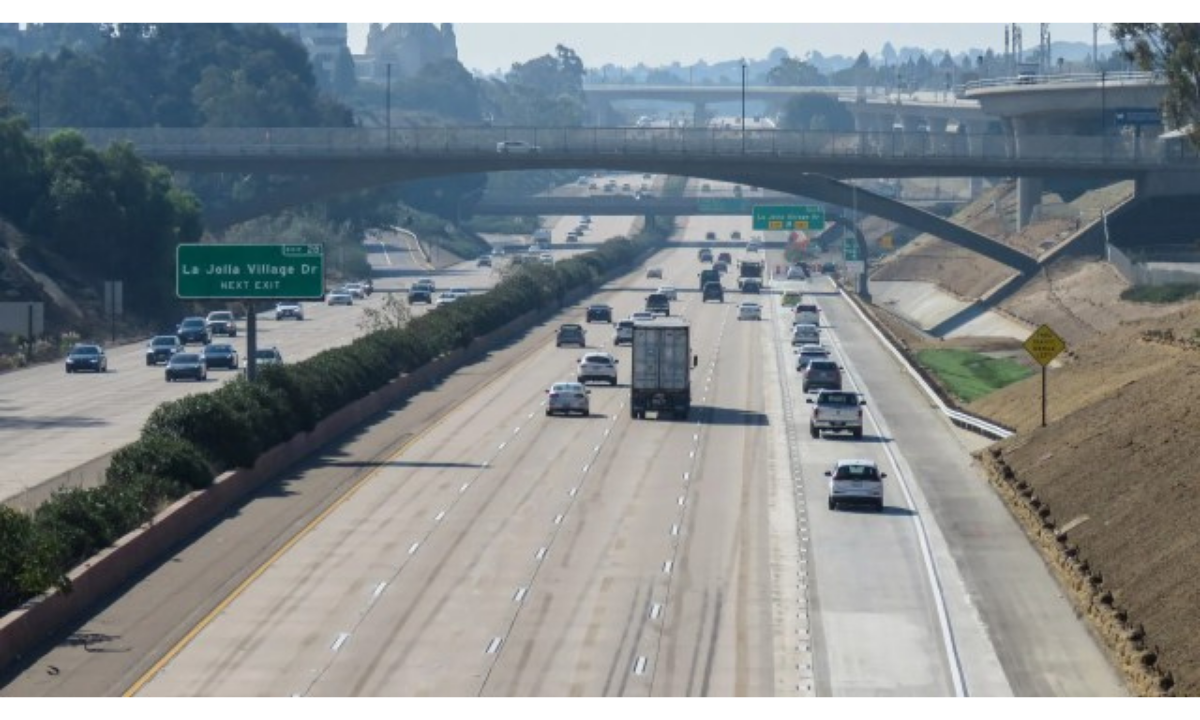

1) Increased FasTrak fees ($34.2 Billion), largely from 819 miles of new managed lanes, including converting some existing free, general freeway lanes along with shoulders

2) Two 0.5% sales tax rate increases from SANDAG. (Ballot 2022, 2028) ($27.8 Billion)

3) One 0.5% sales tax rate increase from MTS. (Ballot 2024) ($9.9 Billion)

4) A surcharge of $.65 – $1.25 per Ridehailing Service ride. (e.g. Uber/Lyft) ($2.1 Billion)

One troublesome aspect of the VMT which got the majority in hot water is a lack of definition other than a max of 4 cents a mile which would include an anticipated state VMT tax starting in 2030 as well.

Would commercial vehicles pay? That would increase the retail price of goods and services. What about exclusions for miles driven out-of-state? Would some groups get discounts or exemptions? Why or why not, and who decides?

For a person driving 13,000 miles per year, the VMT tax would take another $520 per year, per vehicle, out of one’s pocket. And that’s before we even talk about paying 1.5% more in the sale tax rate or any FasTrak fees imposed to use the same, free lane you’re using today.

To be fair, I think any time you throw up an obstacle, you owe one or more bona fide solutions for discussion. Mine are, 1) Make the existing public transit system better so enough people (you don’t need all, for congestion relief) see it as a better cost/benefit choice (key word = choice), and 2) Look at incentives for the private and education sectors in adjusting work and college schedules to avoid rush hour.

As far as meeting state-mandated reductions in GHG emissions, (rhetorically) is the plan to tax us out of gas vehicles into electric ones? We don’t have enough electrical capacity now to avoid blackouts on hot or windy days, much less power a newer, turbo-charged public transit system, all-electric houses, and electric vehicles. And at what price will China loosen its control on the world’s supply of lithium for battery storage?

Finally, what about the proverbial $64,000 question (but really a $269 Billion SANDAG question), “What if we tax our way to a carbon-free utopia in 2050 but China, Russia, and India have done little to nothing in the next 30 years?”

_____

Source:

https://bit.ly/sandag-

La Mesa City Councilmember Laura Lothian also weighs in:

https://www.facebook.com/

Take Action here:

https://www.facebook.com/

Follow East County Advocate:

Photo Cred: SANDAG