Written by Miguel Palacios

This week Gov. Newsom approved a new state stimulus package that will be giving one-time stimulus checks of up to $600 to Californians who qualify. The checks are part of a bigger stimulus bill which also includes grants and fee waivers for small businesses that have been affected by the ongoing pandemic.

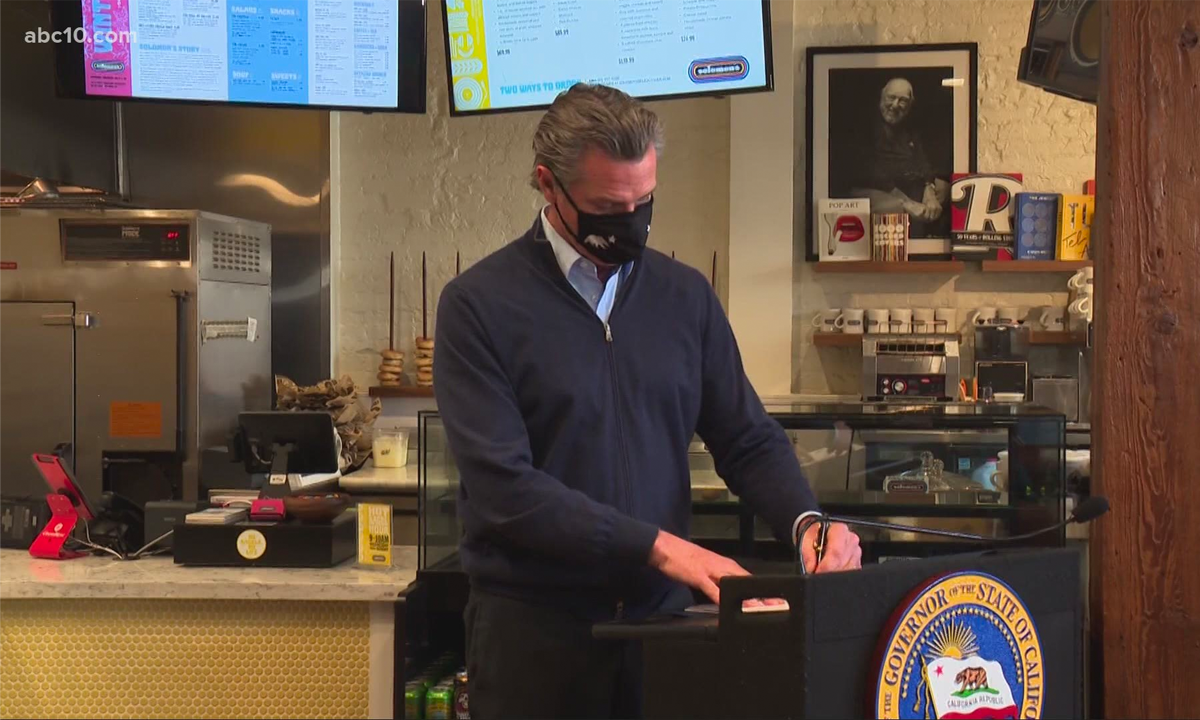

At the bill signing in Sacramento, Newsome commented, “The backbone of our economy is small business. We recognize the stress, the strain that so many small businesses have been under…and we recognize as well our responsibility to do more and to do better to help support these small businesses through this very difficult and trying time.”

Although this appears all well and good, it could be possible that Newsom is reacting to the pressure he is feeling from the Recall Newsom Campaign and that he is trying to appear as a benevolent, caring leader; hoping that people forget why they wanted him recalled.

What we should be asking ourselves is, “why didn’t he do these things sooner?” If he had, then California would not be where it is economically and a state stimulus package/bill may not have been necessary.

Apart from small businesses, the bill claims to be aiming the aid at those who need it the most, but that seems to be off from reality. For instance, anyone who earned up to $75,000 last year and claimed California’s Earned Income Credit will receive a check for up to $600. With that being said, many middle-class families, whose income was over $75,000, also suffered as a result of the pandemic, but they will not be receiving any sort of stimulus.

Also controversial, the bill includes $600 payments for all taxpayers who made under $75,000, including illegal immigrants.

Jon Coupal, president of the Howard Jarvis Taxpayers Association, said that while his organization is in favor of the stimulus payments, they do not believe they should go to illegal aliens.

“Many citizens of California who are taxpayers object to taxpayer dollars given to individuals who are not here under any legal authority,” Coupal said.

And then there is the issue of timing. Although the California relief package was signed by Newsom today, those who qualify to receive aid will have a while to wait until state income tax returns have been disbursed, which can be anywhere between 45 to 60 days. The people who really need the aid need it now. And for the aid being given to the small businesses, we must again ask ourselves, why this was not done earlier. Too many of these small local businesses have already had to close their doors permanently because of the arbitrary lockdown that was enacted by Mr. Newsom. How many of these entities might have been saved from bankruptcy if lockdowns would have been lifted sooner?

One can’t help but feel that Governor Newsom is only acting on his own behalf to recover the constituents he has lost by enacting these quarantine measures, which have hurt so many individuals and businesses up and down the state. Gov. Newsom must realize though that he is a day late and a dollar short. Regardless of what reactionary measures he takes now, Californians will remember how he fumbled the state’s COVID-19 response from beginning to end.

Photo via ABC 10