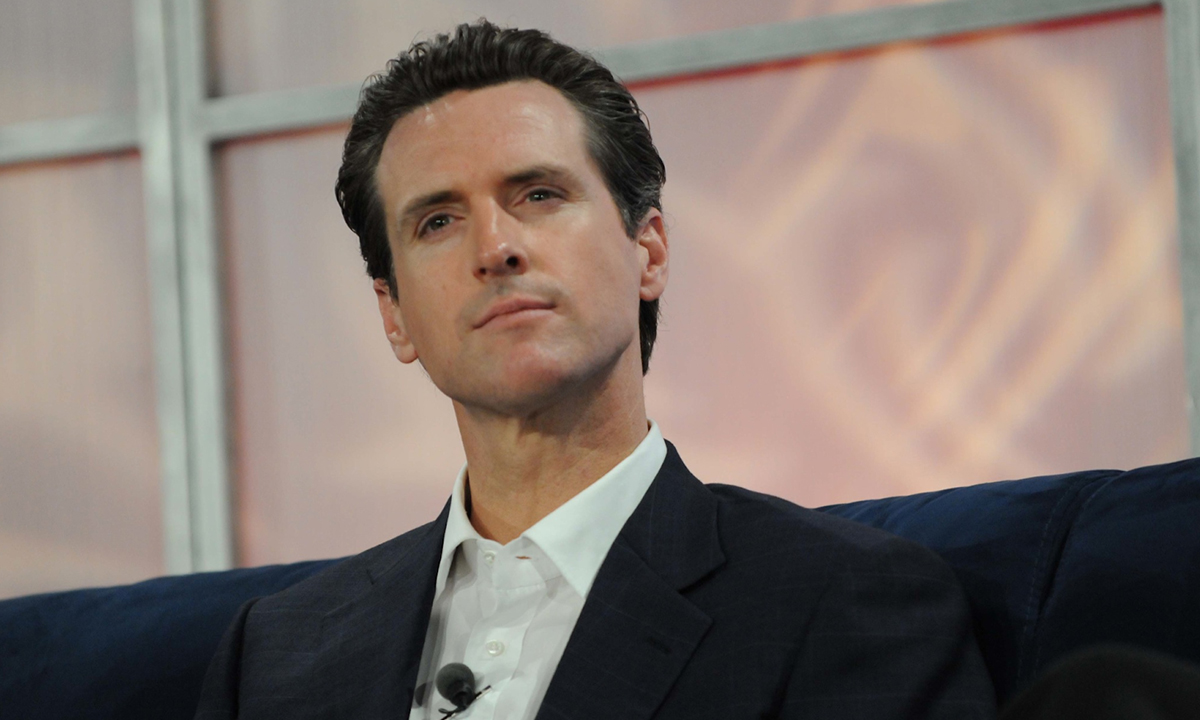

At a news conference with the California Legislative Women’s Caucus on May 7, Governor Gavin Newsom showcased his revised budget proposal and spoke about life essentials.

Newsom touted a sales tax exemption on diapers and menstrual products as well as an additional two weeks of paid leave to care for a new baby or sick family member, all covered under the revised budget proposal.

Gov. Newsom promoted his budget proposal while expressing that he felt it was wrong for the government to increase the cost of life essentials and that doing so hurt families.

Evidently, Gov. Newsom is still wrestling with what constitutes taxable life essentials, as he continues to advocate for his water tax initiative. Newsom’s plan proposes to raise about $140 million annually from a tax placed on water consumption.

Interestingly enough, the state is currently running a record-breaking surplus due to robust tax collections. This surplus can partially be attributed to the approval of Prop 68, which approved billions of dollars in state water bonds for improvements last June.

Within the Association of California Water Agencies, there are approximately 3,000 local water systems throughout the state of California that would be responsible for collecting the tax.

According to Cindy Tuck, the deputy executive director for government relations at ACWA, the state’s budget surplus “makes this the perfect time to create and fund a Safe Drinking Water Trust and ensure access to safe drinking water for residents of these disadvantaged communities.”

This surplus could easily fund water infrastructure improvements in rural farming communities that Newsom’s new water tax is reportedly going to fund anyway. Rather than considering the needs of working families, Newsom continues to cripple them financially by instituting new taxes on life essentials.